Credit Quality Thresholds

Introduction

An equivalent way to represent transition probabilities is by transforming them into credit quality thresholds. These are critical values of a standard normal distribution that yield the same transition probabilities.

An M-by-N matrix of transition

probabilities TRANS and the corresponding M-by-N matrix

of credit quality thresholds THRESH are related

as follows. The thresholds THRESH(i,j)

are critical values of a standard normal distribution z,

such that

TRANS(i,N) = P[z < THRESH(i,N)], TRANS(i,j) = P[z < THRESH(i,j)] - P[z < THRESH(i,j+1)], for 1<=j<N

transprobtothresholds and transprobfromthresholds.Compute Credit Quality Thresholds

This example shows how to compute credit quality thresholds.

To compute credit quality thresholds, transition probabilities are required as input. Here is a transition matrix estimated from credit ratings data:

load Data_TransProb

trans = transprob(data)trans = 8×8

93.1170 5.8428 0.8232 0.1763 0.0376 0.0012 0.0001 0.0017

1.6166 93.1518 4.3632 0.6602 0.1626 0.0055 0.0004 0.0396

0.1237 2.9003 92.2197 4.0756 0.5365 0.0661 0.0028 0.0753

0.0236 0.2312 5.0059 90.1846 3.7979 0.4733 0.0642 0.2193

0.0216 0.1134 0.6357 5.7960 88.9866 3.4497 0.2919 0.7050

0.0010 0.0062 0.1081 0.8697 7.3366 86.7215 2.5169 2.4399

0.0002 0.0011 0.0120 0.2582 1.4294 4.2898 81.2927 12.7167

0 0 0 0 0 0 0 100.0000

Convert the transition matrix to credit quality thresholds using transprobtothresholds.

thresh = transprobtothresholds(trans)

thresh = 8×8

Inf -1.4846 -2.3115 -2.8523 -3.3480 -4.0083 -4.1276 -4.1413

Inf 2.1403 -1.6228 -2.3788 -2.8655 -3.3166 -3.3523 -3.3554

Inf 3.0264 1.8773 -1.6690 -2.4673 -2.9800 -3.1631 -3.1736

Inf 3.4963 2.8009 1.6201 -1.6897 -2.4291 -2.7663 -2.8490

Inf 3.5195 2.9999 2.4225 1.5089 -1.7010 -2.3275 -2.4547

Inf 4.2696 3.8015 3.0477 2.3320 1.3838 -1.6491 -1.9703

Inf 4.6241 4.2097 3.6472 2.7803 2.1199 1.5556 -1.1399

Inf Inf Inf Inf Inf Inf Inf Inf

Conversely, given a matrix of thresholds, you can compute transition probabilities using transprobfromthresholds. For example, take the thresholds computed previously as input to recover the original transition probabilities.

trans1 = transprobfromthresholds(thresh)

trans1 = 8×8

93.1170 5.8428 0.8232 0.1763 0.0376 0.0012 0.0001 0.0017

1.6166 93.1518 4.3632 0.6602 0.1626 0.0055 0.0004 0.0396

0.1237 2.9003 92.2197 4.0756 0.5365 0.0661 0.0028 0.0753

0.0236 0.2312 5.0059 90.1846 3.7979 0.4733 0.0642 0.2193

0.0216 0.1134 0.6357 5.7960 88.9866 3.4497 0.2919 0.7050

0.0010 0.0062 0.1081 0.8697 7.3366 86.7215 2.5169 2.4399

0.0002 0.0011 0.0120 0.2582 1.4294 4.2898 81.2927 12.7167

0 0 0 0 0 0 0 100.0000

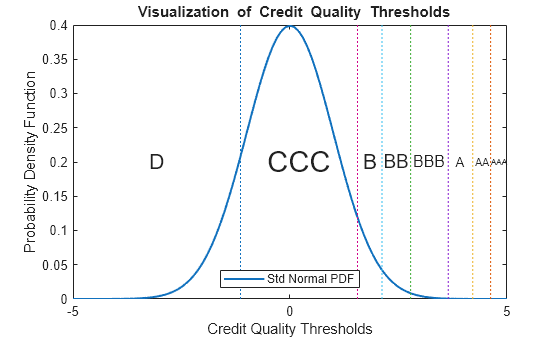

Visualize Credit Quality Thresholds

This example shows how to graphically represent the relationship between credit quality thresholds and transition probabilities.

The following code shows the relationship between credit quality thresholds and transition probabilities for the 'CCC' credit rating. In the plot, the thresholds are marked by the vertical lines and the transition probabilities are the area below the standard normal density curve:

load Data_TransProb trans = transprob(data); thresh = transprobtothresholds(trans); xliml = -5; xlimr = 5; step = 0.1; x=xliml:step:xlimr; thresCCC = thresh(7,:); labels = {'AAA','AA','A','BBB','BB','B','CCC','D'}; centersX = ([5 thresCCC(2:end)]+[thresCCC(2:end) -5])*0.5; omag = round(log10(trans(7,:))); omag(omag>0)=omag(omag>0).^2; fs = 14+2*omag; figure plot(x,normpdf(x),'LineWidth',1.5) text(centersX(1),0.2,labels{1},'FontSize',fs(1), ... 'HorizontalAlignment','center') for i=2:length(labels) val = thresCCC(i); line([val val],[0 0.4],'LineStyle',':') text(centersX(i),0.2,labels{i},'FontSize',fs(i), ... 'HorizontalAlignment','center') end xlabel('Credit Quality Thresholds') ylabel('Probability Density Function') title('{\bf Visualization of Credit Quality Thresholds}') legend('Std Normal PDF','Location','S')

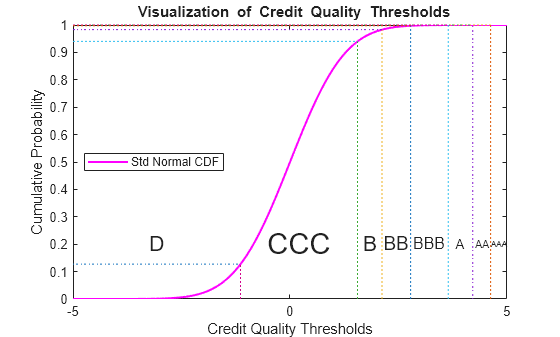

The second plot uses the cumulative distribution function (normcdf) instead. The thresholds are represented by vertical lines. The transition probabilities are given by the distance between horizontal lines.

figure plot(x,normcdf(x),'m','LineWidth',1.5) text(centersX(1),0.2,labels{1},'FontSize',fs(1), ... 'HorizontalAlignment','center') for i=2:length(labels) val = thresCCC(i); line([val val],[0 normcdf(val)],'LineStyle',':'); line([x(1) val],[normcdf(val) normcdf(val)],'LineStyle',':'); text(centersX(i),0.2,labels{i},'FontSize',fs(i), ... 'HorizontalAlignment','center') end xlabel('Credit Quality Thresholds') ylabel('Cumulative Probability') title('{\bf Visualization of Credit Quality Thresholds}') legend('Std Normal CDF','Location','W')

See Also

transprob | transprobprep | transprobbytotals | bootstrp | transprobgrouptotals | transprobtothresholds | transprobfromthresholds

Topics

- Estimation of Transition Probabilities

- Credit Rating by Bagging Decision Trees

- Forecasting Corporate Default Rates